Climate change is no longer a problem for future generations. Its effects are being felt today through extreme weather, rising sea levels, and disruption to ecosystems. As a result, climate change has rapidly climbed the corporate agenda and is now viewed as one of the most material risks to business, the economy and society.

In recognition, regulators globally are moving to mandate climate-related disclosures by companies. This represents the most significant change to corporate reporting in a generation. In June 2022, the Australian Government confirmed its intention to make climate reporting mandatory aligned to the International Sustainability Standards Board (ISSB) framework.

For company directors, this shift brings both risk and opportunity. Diligent directors will embrace this transition as a catalyst for value creation. However, climate reporting also creates new expectations and requires boards to actively oversee the assessment and disclosure of climate risks.

This Blog post provides a summary overview to assist Australian directors in mandatory climate-related reporting.

The Mandatory Climate Reporting Landscape

In November 2021, the ISSB delivered its two proposed climate disclosure standards:

IFRS S1 – requires disclosure of an entity’s governance, strategy, risk management and metrics and targets related to climate-related risks and opportunities.

IFRS S2 – requires disclosure of information about an entity’s significant climate-related financial statement items, risk profile, financial performance and cash flows.

The standards incorporate the framework and recommendations of the Financial Stability Board’s Taskforce on Climate-related Financial Disclosures (TCFD). However, they require more detailed, consistent and comparable disclosures.

The Australian Government has confirmed its intention to make climate-related disclosures mandatory based on the ISSB standards. It is proposed that disclosures be included in the front section of company Annual Reports.

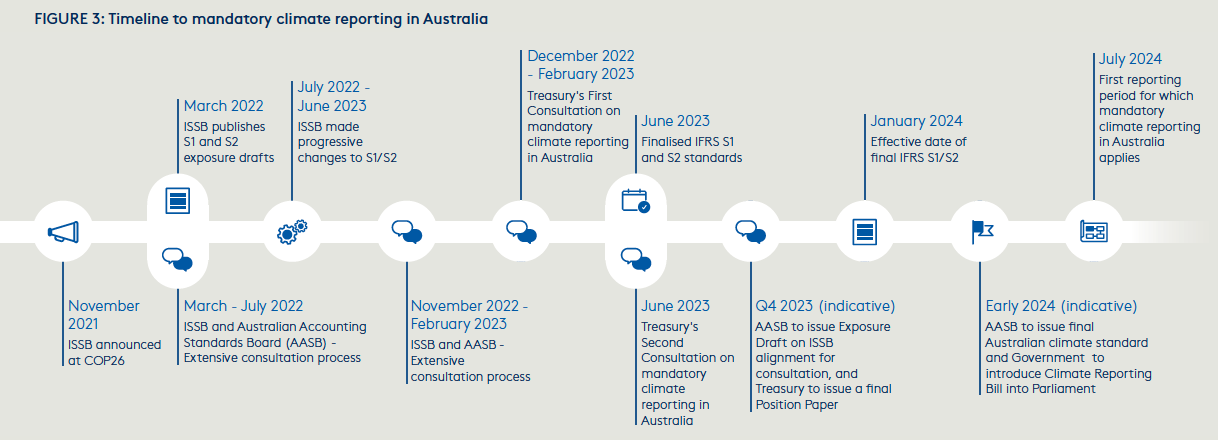

Timelines

Source: Climate Governance Initiative Australia – Directors guide to mandatory climate reporting

The Government has indicated that mandatory reporting obligations will be phased in, starting with large listed companies in 2024 and then following three Cohorts as per below:

Cohort 1: 2024/25 reporting period (Beginning 01 July 2024)

- Over 500 Employees;

- $1 billion+ in consolidated gross assets

- $500 million+ in consolidated annual revenue

- Upstream & downstream Scope 3 supplier emissions from 2025

Cohort 2: 2025/26 reporting period (Beginning 01 July 2026)

- Over 500 Employees;

- $500 million+ in consolidated gross assets

- $200 million+ in consolidated annual revenue

- Upstream & downstream Scope 3 supplier emissions from 2026

Cohort 3: 2027/28 reporting period (Beginning 01 July 2027)

- Over 100 Employees;

- $25 million+ in consolidated gross assets

- $50 million+ in consolidated annual revenue

- Upstream & downstream Scope 3 supplier emissions from 2027

What do Companies need to report?

The content of disclosures will be based on IFRS S2, as adapted to the Australian context by the AASB.

The Australian Government has also provided an overview of disclosures they propose to include governance, qualitative scenario analysis, and climate resilience assessments against two possible future states, one of which must be consistent with the global temperature goal set out in the Climate Change Act 2022, transition plans, climate-related targets (if they exist), identification and management of climate-related risks and opportunities, and scope 1 and 2 emissions.

It is proposed that entities will only be required to disclose material scope 3 emissions (Upstream and Downstream Suppliers) from their second reporting year onwards.

Duties and Expectations of Directors

Legal duties

Directors have an existing legal duty to disclose ‘material’ climate-related risks in financial statements. Under the ISSB standards, materiality is broadly consistent with accounting standards. Information is material if omitting, misstating or obscuring it could reasonably influence investment decisions.

Directors also have a duty to take reasonable steps to ensure the financial and non-financial statements and reports prescribed by legislation are prepared, reviewed and approved.

These duties are enshrined in the Corporations Act 2001 (Cth) and directors can incur both civil and criminal penalties for failing to exercise due care and diligence.

In ASIC v Big Star Energy Ltd (No 3) [2020] FCA 1169, the Federal Court found that a listed company’s directors had breached their duties by failing to recognise and disclose business risks related to climate change. This case demonstrates that directors who ignore climate risk already face heightened legal risk.

Standard of care

The standard of care and skill expected of directors is that of a ‘reasonable person’ in their position. This is an objective test.

With incoming climate reporting requirements, directors can expect greater scrutiny of the governance processes, competencies and oversight exercised regarding climate risk management and reporting.

To demonstrate reasonableness, directors should critically examine whether they have sufficient climate literacy for effective oversight. This includes being able to probe and critique the climate reporting put forward by management.

True and fair view

Under the Corporations Act, financial reports must provide a ‘true and fair’ view of financial position and performance. Directors need to consider whether climate issues could, now or in future, materially impact this position.

For example, climate impacts may require assets to be impaired or devalued. Or, liabilities may need to be recognised. If such information is omitted, the financial statements may not provide a true and fair view.

Even where formal reporting mandates are not yet in effect, directors should be asking what climate-related disclosures might already be required.

Four Steps Directors Can Take Now

The path to mandatory climate reporting brings both risk and opportunity. Diligent directors can oversee this transition in a manner that creates long-term value and resilience.

Here are four practical steps directors can take now to prepare:

Step 1: Review climate governance

- Consider whether climate risks warrant dedicated board oversight – Either through expanding an existing committee’s remit or forming a new sustainability committee.

- Evaluate existing management’s capabilities – Do they have adequate skills and experience regarding climate risk and reporting? If not, this gap needs to be addressed.

- Formalise management responsibilities – Ensure accountability for climate reporting and risk management is clearly defined and incorporated into senior executive KPIs.

- Plan for increased board reporting – Commit to more frequent and more detailed reporting from management on climate risks and reporting. This reflects directors’ obligations for oversight.

- Review board competencies – Identify any gaps in climate literacy amongst directors that need to be addressed through training and up skilling. Climate education should become part of ongoing professional development.

Step 2: Understand the current position

- Review existing climate disclosures – Across financial statements, annual reports, websites and other materials. Is the current messaging consistent, accurate and aligned to TCFD/ISSB?

- Analyse operational footprint – Understand the company’s current greenhouse gas emissions, targets, performance against targets, and abatement opportunities.

- Identify data gaps – Determine what additional climate-related data needs to be measured and monitored to support mandated reporting.

- Commission scenario analysis – Gain insight into strategic and financial risks and opportunities under different climate scenarios e.g. less than 2°C warming.

- Focus on material impacts – Prioritise gathering data and implementing systems to report on material climate risks and metrics first. Recognise that metrics and reporting will mature over time.

Step 3: Develop a climate strategy

- Set emission targets – Commit to science-based or net zero aligned targets across Scopes 1, 2 and material elements of Scope 3. This demonstrates strategic intent.

- Model transition pathways – Develop plausible scenarios for adapting business models, assets and operating models to align with emission targets and address material climate risks.

- Stress test against scenarios – Evaluate the transition plan under different climate scenarios to identify vulnerabilities, contingencies and additional mitigation options.

- Disclose targets and transition strategy – Be transparent with shareholders and other stakeholders about the strategic approach, key dependencies, assumptions and risks.

Step 4: Assure reporting processes

- Verify data inputs – Ensure adequate controls and assurance over the accuracy of climate data and statements.

- Validate materiality assessments – Scrutinise the materiality analysis and exercise independent judgement on reported content.

- Review final documents – Rigorously assess whether climate risks are adequately disclosed and the overall tone aligns to the board’s understanding.

- Consider external assurance – For larger companies, have disclosures independently audited or assured to provide credibility.

- Monitor emerging risks – Recognise that risks and reporting expectations will evolve over time. Ongoing board oversight is required.

Effective Climate Governance is Foundational

Climate change is a complex, systemic issue touching all aspects of an organisation’s business. Boards need governance structures that provide clear accountability and oversight of climate risks, opportunities and reporting.

This starts with board mandates. Committees overseeing risk, strategy and reporting should have climate change explicitly included in their charters. For some organisations, a dedicated board-level climate committee may be warranted.

Regular calendar time must be allocated for the board to oversee climate issues. This is particularly crucial leading up to annual reporting, to review proposed disclosures.

As climate reporting matures, governance structures should evolve. The board may need more time devoted to climate change as risks and opportunities come into sharper focus. Directors must periodically assess whether board structures remain fit-for-purpose.

Competencies are equally important. Boards should identify any gaps in climate change expertise amongst directors. Recruiting directors with sustainability backgrounds can significantly boost the board’s understanding.

All directors, however, need a strong grasp of climate risks and opportunities facing the organisation. Regular training and education is key to building board competencies over time.

By ensuring robust climate governance, boards put their companies on the right footing to manage risks, seize opportunities and provide high-quality disclosures to investors.

Steps to effective climate governance:

- Review board mandates and charters to explicitly include climate change

- Build climate change into the board calendar

- Consider forming a dedicated climate committee

- Assess board competencies and organize training

- Recruit directors with climate change and sustainability expertise

- Periodically reevaluate climate governance structures

Climate Strategy Requires Assessing Risks and Opportunities

Mandatory climate reporting requires organisations to disclose their climate-related risks and opportunities, over short, medium and long-term horizons. This necessitates developing a climate strategy aligned to the business.

Boards play a key role in working with management to deeply understand climate risks and opportunities across the value chain. This means looking beyond immediate operations to consider impacts on key suppliers and distribution channels.

Quantifying potential financial impacts is crucial. For example, how could a changing climate affect input costs? Could extreme weather disrupt distribution networks? What market changes are ahead as economies decarbonise? Boards should analyse effects on profitability, cash flows, balance sheet composition and more.

With risks and opportunities identified, management can develop a climate strategy, focused on material issues facing the business. This requires assessing low-carbon transition opportunities and setting a path to decarbonise operations. Strategy must be periodically reviewed as climate change accelerates and business conditions evolve.

Boards also need to ensure climate-related risks, opportunities and strategy are clearly communicated in annual disclosures. With mandatory reporting, transparency on these issues is no longer optional.

By taking a strategic, forward-looking approach, boards can position their companies to build resilience and harness new opportunities emerging from the low-carbon transition.

Key steps in climate strategy:

- Identify short, medium and long-term climate risks and opportunities

- Quantify potential financial impacts across the value chain

- Develop a climate strategy and transition plan

- Continually monitor and review the strategy

- Oversee clear communication in annual disclosures

Data and Targets Enable Tracking of Climate Risks and Opportunities

Metrics and targets provide the data needed for organisations to implement climate strategies and track performance against goals. This enables demonstrating progress to investors through annual reporting.

For many organisations, the starting point is understanding their current carbon footprint. Measuring Scope 1, 2 and material Scope 3 emissions provides a baseline from which to improve. Identifying and addressing any data gaps is crucial.

With emissions quantified, science-based decarbonisation targets can be set across short, medium and long time horizons. Targets should align to the climate strategy while allowing flexibility to adapt as risks and opportunities evolve.

Metrics are also needed on other climate-related risks and opportunities specific to the business. This could include water usage in drought-prone regions, supply chain resilience, or physical risk exposure.

Boards must ensure proper data collection processes, controls and systems are in place for reliable reporting. Third party assurance may also be warranted to provide confidence over disclosures.

By implementing robust metrics and targets tied to climate risks and opportunities, organizations demonstrate commitment to investors and can track progress towards goals.

Key steps on metrics and targets:

- Measure current carbon footprint, identifying any data gaps

- Set emissions reduction targets aligned to climate strategy

- Develop metrics tailored to the company’s climate risks and opportunities

- Assess data collection processes and systems

- Consider assurance for climate disclosures

In conclusion

Climate reporting brings a new world of governance challenges. But done well, it can drive strategic advantage and resilience. Diligent directors will seize this transition as an opportunity for long-term value creation.

Companies that embed climate change in governance structures, set science-based strategies and track performance have a clear advantage. They are better placed to manage increasing climate risk, realise new opportunities and provide the transparency that investors demand.

If you need assistance in establishing a robust strategy Misio is able to assist with an end-to-end solution allowing organisations to set up their tailored sustainability roadmap, and transparently showcase progress in implementing their plan. To create your organisation’s profile and receive your customised roadmap aligned with global standards schedule a time with out team at: https://hq.misio.io/contact

A detailed document regarding this topic may be found on the AIDC website.